The logic of staking plans

A staking plan, or a system, is designed to minimise your risks while maximising profits. Among the most popular plans there are loss recovery plans, profit accumulators and bank management systems. There are many others, including mixtures of different approaches. But they all share one common property: they rely on clear, predetermined rules to control the size of each bet.

Before triggered betting was invented, you would either follow a staking plan manually by doing all the calculations on paper, or pay for a tailored bot, or program your own piece of code that would do the job.

Well, MarketFeeder Pro allows you to realise virtually any staking plan or system you can imagine. If you are not sure this is possible, check our library of Staking Plan Solutions with ready to download trigger files.

Each staking plan can be implemented through a set of triggers, or instructions to the program on what to do, and when to do that. In the context of staking plans and systems, triggers perform typical tasks:

- Register the loss from the previous markets;

- Add or deduct the loss from the next bet;

- Reset the stake size after a winning bet or after it has reached the maximum;

- Increment some sort of cycle counter;

- Place the bets in chosen markets etc.

The order of these actions is normally typical as well. Just like you would first adjust your stake and only then place it, the triggers need to be put one after another in specific order. Here is a simple example.

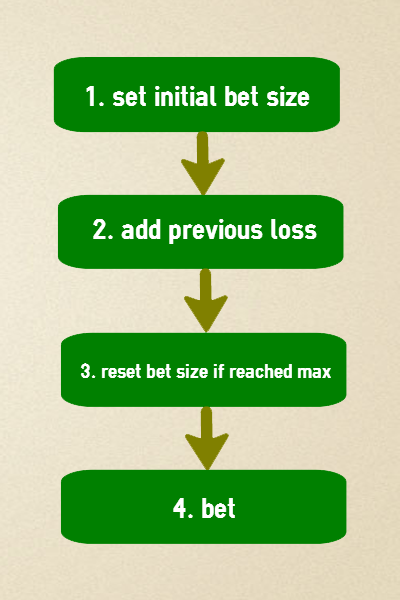

The correct order of steps in a staking plan

So first I define the size of my bet, or the unit as it is often called in system descriptions. Then I need to adjust the size of the bet if it is not my first one, and if there has been loss. After that I will check if the adjusted bet has reached the maximum level and, if yes, reset it. Having done all that, I may get to the actual betting.

The above is probably not the way you usually plan your bets. Perhaps you put betting first, and think of the rest as it comes to your mind. But let’s see what happens if we reorder these steps.

The incorrect order of steps in a staking plan

So I tell the program to bet. But it does not know how much to bet as I haven’t specified the size of the bet yet. Usually this is where my incorrect staking plan should end, but let’s assume the program is smart enough to place a default sized bet.

Next step in my faulty plan is to check whether my bet has reached the maximum. Of course it can’t happen in the first cycle, but let’s fast forward to, say, the 10th cycle where the bet has accumulated all the previous losses. The program will reset the bet to the initial size. Wait a moment, which initial size? Didn’t I forget to set it in the first place?

Just to damage this more in the next step, the program will add the previous loss to the bet I’ve just reset! So the logic of resetting after a maximum is broken because of the wrong order of these actions.

Finally, I get to actually setting the size of my first bet. But by that time nobody cares, as this plan is already nonviable.

To those who may think I’m speaking Chinese: there are lots of standard solutions in our library that will help you to start with very simple plans which can be tested right away. To quickly get to practice, here is a simple step-by-step instruction on how to set up a loss recovery plan in MarketFeeder Pro.

Download the trigger file from the video.

From my experience, bettors always want an extra, e.g. set a cap on a bet, define the cycle length, stipulate more conditions for the market and selections, adjust for the exchange commission etc. If you need our hand in creating a perfect plan, or you just looking for where to start, do not hesitate to contact us for a trigger advice.