Backing in the Place market on horses whose prices have increased in the Win market

Description

This strategy is so counter-intuitive that I struggle with finding a rationale behind it.

I stumbled upon it when I was testing the opposite idea – to back on horses whose prices have shortened over the given period. But I noticed that this idea would invariably lead to a loss, see a typical statement below.

If you look at the statement, you can see that the number of losses outweighed the number of wins, and given the low average odds of the bets, this was leading me to nowhere.

So I decided to do what comes to the mind of many newbies: to do exactly the opposite:

1. At 30 seconds before the start of a horse race, look for horses whose chances have decreased in the Win market over the last 5 minutes by the specified percentage. A chance is calculated as 100%/price, so for example, if the price was 4.0 and then became 5.0, the chance of this horse has decreased by 100/4.0 – 100/5.0 = 5%.

2. Otherwise look for a horse whose rank has increased since the moment you started refreshing the market. For example, if at the beginning the horse was the first favourite and later, at the time of betting, it became the second favourite, then this is the candidate for backing.

3. Back on the qualifying horse(s) in the Place market.

4. There is a loss recovery plan involved: after the loss, you increase your next 3 bets by 1.2 to compensate for the loss. Then the bet reverts to the initial size (a percentage of your bank). Note that the sequence does not restart after each loss: instead it is pursued for a fixed number of steps, regardless of how many losses will be in between.

Example:

Initial bet is 1 unit.

- Back 1 unit. Lost.

- Back 1.2 units. Lost.

- Back 1.2 units. Won.

- Back 1.2 units. Won.

- Back 1 unit. And so on...

Triggers

Download the trigger setup file.

Profile name: back-place-increased-price-in-win

How to run this trigger package:

1. Download and run the above installation file.

2. It contains three files: the trigger file, the Market Locator search template and the program settings. These files will be copied to corresponding folders on your computer (where other triggers and templates are already stored).

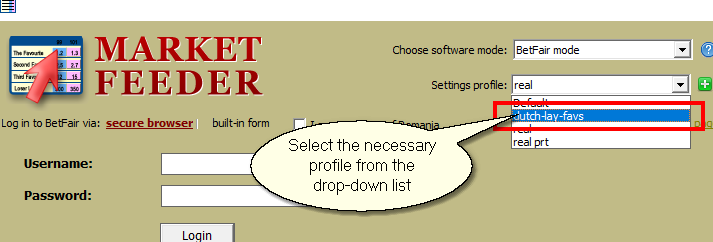

3. Run MarketFeeder Pro and choose the right settings profile from the drop-down list:

Here are the constants you can adjust:

| max_rank | Maximum rank of the horse (1 is the first favourite) |

| chance_drop | How much the chance for winning must drop in the Win market (in %). Chance = 100/price |

| mins_before_off | Time for the bet (minutes before the off) |

| interval | Time interval over which the price must go up (and chance do down) |

| bet_profit | Expected profit from the bet, % of bank |

| multiplier | Number by which you multiply the next bet after a loss |

| cycle_length | Number of steps in the loss recovery cycle (how many bets to multiply by multiplier) |

| max_price | Maximum price of the bet |

So what shall we make of this experiment?

Triggers In Action

Day 1, January 09, 2019

This is the first Trigger in Action sequence where I did not change any settings throughout the testing period!

Total P/L: 7.19

ROI: 1.34%

Wins: 16, losses: 16.

Download Statement for 09/01/2019

Day 2, January 10, 2019

My Windows updated and restarted overnight that day – I only discovered that in the morning after I checked my VPS. So that day the triggers did not back in the Australian markets.

Total P/L: 88.00

ROI: 18.22%

Wins: 19, losses: 11.

Download Statement for 10/01/2019

Day 3, January 11, 2019

Just kept testing really.

Total P/L: 54.06

ROI: 1.88%

Wins: 64, losses: 47.

Download Statement for 11/01/2019

Day 4, January 12, 2019

That’s when the fortune pendulum started swinging in the opposite direction, like it often does:

Total P/L: -17.83

ROI: 0.92%

Wins: 57, losses: 55.

Download Statement for 12/01/2019

Day 5, January 13, 2019

Another day of testing. I was travelling abroad, so did not have much opportunity to check on my triggers until late at night.

Total P/L: -54.25

ROI: -4.22%

Wins: 34, losses: 27.

Download Statement for 13/01/2019

Day 6, January 14, 2019

The pendulum I mentioned above was now changing its direction again. No changes, just kept going as it was.

Total P/L: 2.73

ROI: -0.24%

Wins: 29, losses: 21.

Download Statement for 14/01/2019

Day 7, January 15, 2019

Total P/L: 20.65

ROI: 1.43%

Wins: 35, losses: 24.

Download Statement for 15/01/2019

I had my return flight that night, so I decided to leave it in until tomorrow and have the last day of testing.

Day 8, January 16, 2019

Total P/L: 66.62

ROI: 4.42%

Wins: 46, losses: 34.

Download Statement for 16/01/2019

My bank balance and statistics:

I don’t really know what to say about this strategy: it seems silly at the first sight, but it is producing good results, although they are far from being consistent.

I think it is the combination of high odds and loss recovery that did the trick. At any rate, if you reverse this strategy, i.e. lay on horses that satisfy these criteria or back those whose price has shortened, you will be in a much worse position (I have tested both, so believe me).

If you liked this trigger review, sign up for our newsletter to be the first to learn about new reviews!

Download the trigger installation file above and start testing this strategy right now! Are you not using MarketFeeder Pro yet? Try now!

How and where I test the triggers?

I use our BetVPS service to pre-set the triggers and Market Locator and leave it to run on its own until I check on the results at the end of the day.I occasionally use Time Machine to get a proof of concept or test any tweaks that I want to make to my triggers, on historical markets similar to the ones in which I bet when testing a particular strategy.

I use Test Mode only.

You can generate your own graph and statistics like the ones in these Triggers in Action reports. Read how to do this.

If you would like a unique guest-post for your blog covering one of such strategies, please email me a request.