Lay Dutching on players in Tennis

Description

It’s Lay Dutching with a bit of price adjustment. You initially place two lay bets on both players in the Match Odds market in Tennis. Unlike most tennis strategies, this one does not require the score to be available.

The bets must be calculated in such a way that the sum of their chances (100 divided by their price) is greater than 100 (how much greater is defined in the constants).

If both bets get matched as the game progresses, you earn profit and do nothing in that market.

If one of the bets stays unmatched and the market goes against you (either the price drifts away or the player shows signs of losing the set), cancel that bet and place a new one that distributes the loss equally.

This idea stemmed from the popular strategy of laying on the whole field (in horse racing) at a price below 2.0 in the hopes of having more than one bet matched. As you may well know (if you don’t, please read this article first), when the sum of the chances of the selections you lay against is greater than 100%, you earn guaranteed profit by laying on them, provided that all your bets get matched.

Having tested the above strategy for a couple of days, I realized it was not going to make a hit and modified it for tennis, to include only two bets, and to bet at the lowest possible prices to attain a certain percentage of profit.

The main expectation behind this is that the prices of tennis players may change dramatically between the games, so there is often a chance that the favourite loses its position and the underdog comes forward as the new favourite (and thus his/her price drops). They sometimes swap places several times during the match.

See below what I have achieved with this strategy.

Triggers

Download the trigger setup file.

Profile name: lay-dutching-in-tennis

How to run this trigger package:

1. Download and run the above installation file.

2. It contains three files: the trigger file, the Market Locator search template and the program settings. These files will be copied to corresponding folders on your computer (where other triggers and templates are already stored).

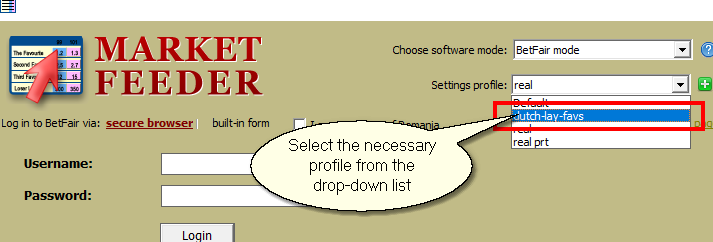

3. Run MarketFeeder Pro and choose the right settings profile from the drop-down list:

Here are the constants you can adjust:

| bet_size | Total max. liability of both bets, % of the bank |

| target_profit | Total profit after which to stop betting (% of the starting bank) |

| target_loss | Total loss after which to stop betting (% of the starting bank) |

| bet_price | Maximum price of the favourite player |

| max_fav_dif | Maximum difference between the prices of the fav and underdog |

| min_ovr | Minimum overround |

| sl_perc | Price increase (percentage) for stop-loss |

| min_trd_games | Minimum advantage in games won for a stop-loss |

| min_vlm | Minimum market volume |

By doing some preliminary tests, I noticed that this strategy had a tendency to start well and then deteriorate during the day. Therefore, the critical part of this strategy is to balance your expected profit and the size of bet, so that you could stop as soon as you’ve earned a predefined amount of money, then stop for the day.

Triggers In Action

Day 1, February 21, 2019

I started testing the triggers with the following settings:

| bet_size | 2 |

| target_profit | 1.5 |

| target_loss | 40 |

| bet_price | 1.7 |

| max_fav_dif | 2.5 |

| min_ovr | 10 |

| sl_perc | 40 |

| min_vlm | 400 |

Like I said, I came prepared and already had the above figures in mind when I started. People normally aim to earn anything from 10% to 40% of their starting bank in a day, but with this strategy it is absolutely unrealistic.

Total P/L: -2.66

ROI: -0.46%

Wins: 23, losses: 10.

Download Statement for 21/02/2019

Day 2, February 22, 2019

I was not satisfied with my settings because many of my bets ended up below the allowed BetFair minimum (2 GBP in my case), so I increased bet_size to 5%.

Looking at the losing sequence at the end of the previous day, I also decided to stop earlier, at 1% of my starting bank:

| bet_size | 5.0 |

| target_profit | 1.0 |

I also looked closely at some of the player on which the triggers cancelled the initial bet and closed it with another bet at the current price (which was obviously much worse). But that player later came to win the match. Take, for example, Arruabarrena/Christian – the pair eventually won after my triggers laid on them at 10.0!

So maybe I was triggering the stop-loss too early? I introduced another rule, which was to wait and not close the bet unless it was the second set or the player was at least 3 games behind the current favourite:

| min_trd_games | 3 |

Here is what I got that day:

Total P/L: 16.23

ROI: 3.21%

Wins: 11, losses: 6.

Download Statement for 22/02/2019

Day 3, February 23, 2019

To my surprise, the second day yielded profit, albeit some of you may shrug it off as pocket change.

I continued into the next day without changing anything.

Total P/L: 13.67

ROI: 5.37%

Wins: 4, losses: 2.

Download Statement for 23/02/2019

Day 4, February 24, 2019

Wow, that was probably the shortest betting day in the history of Triggers In Action.

I analysed the matches where the conditions of the triggers were not satisfied (therefore, the triggers did not bet), and thought that I could increase the maximum price of the favourite player to include more markets.

| bet_price | 1.95 |

Total P/L: 14.20

ROI: 12.32%

Wins: 3, losses: 0.

Download Statement for 24/02/2019

Day 5, February 25, 2019

With just three markets the previous day, all winning, I had to fight the temptation to go further and increase my profit limit for the next day. But discipline is what’s missing in most bettors’ behaviour, and I want to set a good example here.

For the next day I corrected an error in the stop-loss trigger to account for some markets without the score (the trigger was checking the current set number, which is equal to 0 in the markets where the score is not supported). I did not change any settings till the very end of this testing session.

Total P/L: 12.53

ROI: 1.67%

Wins: 11, losses: 6.

Download Statement for 25/02/2019

Day 6, February 26, 2019

You see, I was glad I did not change my profit target: it was much harder to achieve it the previous day!

Total P/L: 15.80

ROI: 2.02%

Wins: 12, losses: 7.

Download Statement for 26/02/2019

Day 7, February 27, 2019

I dreaded that the last day would generate loss, as it always happens when the losing trend starts to emerge. But luckily, I was wrong.

Total P/L: 16.38

ROI: 5.17%

Wins: 6, losses: 2.

Download Statement for 27/02/2019

My bank balance and statistics:

This Lay Dutching strategy is nothing special, probably a trifle compared to more aggressive loss recovery examples, but I was impressed by its consistency.

I leave it up to you to try and tweak the constants to see if you can push the profit margin further. Specifically, you can experiment with bet_size, target_profit and min_ovr.

If you liked this trigger review, sign up for our newsletter to be the first to learn about new reviews!

Download the trigger installation file above and start testing this strategy right now! Are you not using MarketFeeder Pro yet? Try now!

How and where I test the triggers?

I use our BetVPS service to pre-set the triggers and Market Locator and leave it to run on its own until I check on the results at the end of the day.I occasionally use Time Machine to get a proof of concept or test any tweaks that I want to make to my triggers, on historical markets similar to the ones in which I bet when testing a particular strategy.

I use Test Mode only.

You can generate your own graph and statistics like the ones in these Triggers in Action reports. Read how to do this.

If you would like a unique guest-post for your blog covering one of such strategies, please email me a request.