Laying on the horse whose price never dropped, and trading it out at In-Play

Description

Here is what the triggers are programmed to do.

- At 10 minutes before the beginning of a horse race (I tested the strategy in UK & IRE races) start monitoring the prices.

- Record all horses whose price has dropped by at least 5 ticks over the time left till the off. More than half the field must have their prices dropped — that’s one of the main conditions of the bet.

- At 30 seconds before the off lay on the lowest priced horse whose odds have NOT dropped till then.

- Later on green up for 15 ticks of profit or stop loss at 20 ticks of loss.

Triggers

Download the trigger setup file.

Profile name: lay-horse-price-not-dropped

How to run this trigger package:

1. Download and run the above installation file.

2. It contains three files: the trigger file, the Market Locator search template and the program settings. These files will be copied to corresponding folders on your computer (where other triggers and templates are already stored).

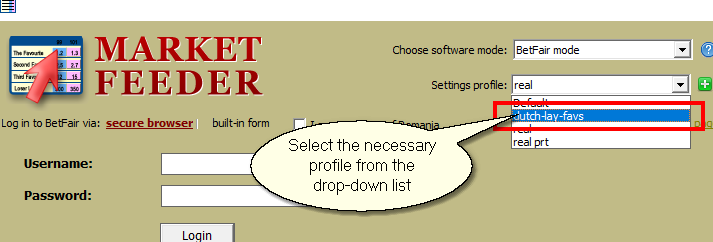

3. Run MarketFeeder Pro and choose the right settings profile from the drop-down list:

Here are the constants you can adjust:

| mins_before_start | When to start monitoring the prices |

| drop_tcks | How much the prices must drop, ticks |

| bet_size | Size of the bet |

| min_price | Minimum price |

| max_price | Maximum price |

| bet_min | When to place the bet, minutes before the off |

| greenup_tcks | When to green up, price ticks |

| sl_tcks | When to stop loss, price ticks |

| min_dropped | Minimum number of horses whose prices dropped, % of the total number of selections |

Remember that you need to adjust the Monitoring Options to start monitoring markets no later than at the time specified in mins_before_start.

The size of bet is an absolute number, but you can set it to a percentage of bank and change the Amount value of the laying trigger to:

bet_size*IF(test_mode=1, test_funds, total_funds)/100

Triggers In Action

Day 1, February 06, 2020

I started testing the triggers with the following settings:

| mins_before_start | 10 |

| drop_tcks | 3 |

| bet_size | 10 |

| min_price | 1.5 |

| max_price | 15 |

| bet_min | 0.5 |

| greenup_tcks | 5 |

| sl_tcks | 10 |

| min_dropped | 51 |

These settings are not especially ambitious: I was looking for half the field’s prices to drop by 3 ticks. E.g. if a horse had the odds of 9.5 at 10 minutes before the off, I needed it to get to 9.2 or lower to qualify for a marker horse. As long as the majority of the runners were marker horses, I was going to lay the lowest-priced non-marker.

Total P/L: 18.76

ROI: 5.85%

Wins: 13, losses: 4.

Download Statement for 06/02/2020

Day 2, February 07, 2020

Not bad for a start. I kept going with the same settings for a few days.

Total P/L: 13.26

ROI: 3.11%

Wins: 16, losses: 6.

Download Statement for 07/02/2020

Day 3, February 08, 2020

Total P/L: 25.02

ROI: 6.34%

Wins: 18, losses: 3.

Download Statement for 08/02/2020

Day 4, February 10, 2020

There were no races on February 9 in Britain and Ireland due to Storm Ciara, so there is a gap in my testing period, the next betting day being February 10.

Total P/L: -8.65

ROI: -4.15%

Wins: 6, losses: 4.

Download Statement for 10/02/2020

Day 5, February 11, 2020

Judging from the previous day’s account statement, in many cases the stop-loss kicked in too soon, i.e. the horse went on to lose the race anyway, so I decided to make the triggers wait longer in a hope for a green-up. I also wanted to see how much my results would change if I set the price drop condition to 5 ticks (a more aggressive decrease in price as compared to the earlier 3 ticks). I changed the following settings:

| greenup_tcks | 8 |

| sl_tcks | 13 |

| drop_tcks | 5 |

Total P/L: 7.69

ROI: 6.86%

Wins: 6, losses: 0.

The number of bets was equally small (even less races would now qualify), but luckily I did not suffer any losses.

Download Statement for 11/02/2020

Day 6, February 12, 2020

Total P/L: -0.12

ROI: -0.20%

Wins: 2, losses: 1.

This was a waste of time basically: only three races met the conditions. The rest did not have enough horses with decreased prices.

Download Statement for 12/02/2020

Day 7, February 13, 2020

I changed the settings again, for the last time in this testing session.

| greenup_tcks | 15 |

| sl_tcks | 20 |

Total P/L: -1.79

ROI: -1.76%

Wins: 3, losses: 2.

Download Statement for 13/02/2020

Day 8, February 14, 2020

Total P/L: -2.96

ROI: -1.33%

Wins: 6, losses: 5.

Download Statement for 14/02/2020

Day 9, February 15, 2020

Total P/L: 12.59

ROI: 4.72%

Wins: 9, losses: 5.

Download Statement for 15/02/2020

Day 10, February 16, 2020

Total P/L: -16.36

ROI: -14.07%

Wins: 1, losses: 4.

Download Statement for 16/02/2020

Day 11, February 17, 2020

Total P/L: 25.02

ROI: 33.60%

Wins: 5, losses: 0.

Download Statement for 17/02/2020

Day 12, February 18, 2020

Total P/L: -30.38

ROI: -10.47%

Wins: 5, losses: 8.

Download Statement for 18/02/2020

Day 13, February 19, 2020

Total P/L: -10.67

ROI: -8.18%

Wins: 3, losses: 3.

Download Statement for 19/02/2020

Day 14, February 20, 2020

Total P/L: -7.33

ROI: -2.97%

Wins: 6, losses: 6.

Download Statement for 20/02/2020

Day 15, February 21, 2020

Total P/L: 19.36

ROI: 6.06%

Wins: 11, losses: 6.

Download Statement for 21/02/2020

Day 16, February 22, 2020

Total P/L: -5.43

ROI: -2.22%

Wins: 6, losses: 6.

Download Statement for 12/02/2020

Day 17, February 23, 2020

Total P/L: 6.65

ROI: 7.14%

Wins: 4, losses: 1.

Download Statement for 23/02/2020

My bank balance and statistics:

| Starting Bank: | 1000 |

| Final Bank: | 1044.58 |

| Max. Drawdown: | -102.59 |

| Max. Profit: | 85 |

| Max. single-bet loss: |

-100

|

| Total P/L: |

44.58

|

| ROI: | 1.14% |

Strategies with low risk always appeal to me, although, like I said in another Trigger in Action, green-up strategies rarely bring you impressive profit if you do not do scalping. By looking at the profit/loss graph, you will notice what seem like a lot of troughs, but those are losses from one of the bets in the pair (like the -£100 from a lay bet at the price of 11.0 on the first day of testing) – they are always covered (in part or in full) by the profits from the second bet. Your actual liabilities are low because every bet is traded out at some point: the worst-case scenario is you are going to lose a percentage of your bet if the stop-loss trigger kicks in.

This is an in-and-out strategy though, as you will regularly end a day with a loss now and then. The question is, will the profits compensate those losses in the long run and what you can do to minimize the latter ones?

All in all, I’d recommend testing this swing strategy for a couple of days and experiment with the green-up and stop-loss ticks. I got the feeling that staying within the range of 8-15 green-up ticks and 13-20 stop-loss ticks was a better idea than increasing it like I did after February 13. What are your thoughts on this?

If you liked this trigger review, sign up for our newsletter to be the first to learn about new reviews!

Download the trigger installation file above and start testing this strategy right now! Are you not using MarketFeeder Pro yet? Try now!

How and where I test the triggers?

I use our BetVPS service to pre-set the triggers and Market Locator and leave it to run on its own until I check on the results at the end of the day.I occasionally use Time Machine to get a proof of concept or test any tweaks that I want to make to my triggers, on historical markets similar to the ones in which I bet when testing a particular strategy.

I use Test Mode only.

You can generate your own graph and statistics like the ones in these Triggers in Action reports. Read how to do this.

If you would like a unique guest-post for your blog covering one of such strategies, please email me a request.