Backing on the dog with the greatest volume at X minutes before the race

Description

This is yet another Trigger in Action inspired by a BFStats report. The idea came to me a few months ago when I noticed a downtrend in the last traded price of a dog with the greatest matched volume.

I wanted to find out how likely it is that, if a back on a greyhound with the maximum matched volume, its price will steadily decline in the last few minutes before the off, allowing enough margin to green it up to an equal profit.

This testing session had two strategy pivots along the line, so let me give you the breakdown of all three strategies tested. You will find the triggers implementing all three strategies down the next section.

Strategy 1

Back on the dog with the greatest matched volume percentage at 3 minutes before the start of the race. Trade it out with a lay bet at exactly the scheduled start time of the race.

Strategy 2a

Back on the dog with the greatest matched volume percentage at 2 minutes before the start of the race. Leave the bet there no matter where the price goes.

Strategy 2b

Using Market Locator, filter out markets with a predefined list of distances, as selected using the BFStats report. Back on the dog with the greatest matched volume percentage at 2 minutes before the start of the race. Leave the bet there no matter where the price goes.

Conditions and restrictions common for all three strategies

No loss recovery, no restrictions on the rank or price range of the dog. The minimum and maximum difference between the volume % of the dog with the greatest volume and the dog with the second greatest volume % (the volume gap) are 5% and 80% respectively. That is, if the first dog has 30% of the market money and the second dog has 25%, that market qualifies (30-25 = 15, which falls into the range). However, if the first dog has 90% of the money and the next one has 5%, that market will not qualify as 90-5 > 80.

Triggers

Download the trigger setup file.

Profile name: back-greyhound-volume

How to run this trigger package:

1. Download and run the above installation file.

2. It contains three files: the trigger file, the Market Locator search template and the program settings. These files will be copied to corresponding folders on your computer (where other triggers and templates are already stored).

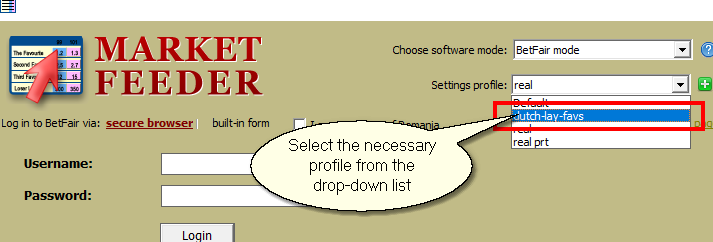

3. Run MarketFeeder Pro and choose the right settings profile from the drop-down list:

The link above is to a setup file for Strategy 2b. You will find links to trigger files with other two strategies on the corresponding days when I switched to them.

Here are the constants you can adjust:

| min_odds | Minimum betting price |

| max_odds | Maximum betting price |

| min_runners | Minimum number of runners |

| min_rank | Minimum selection rank (1 - the first favourite) |

| max_rank | Maximum selection rank (1 - the first favourite) |

| mins_before_start | When to place an opening bet (minutes before the off) |

| greenup_time | When to green up, minutes before the off |

| init_bet | Size of initial bet (see relative_bets and stake_type) |

| relative_bets | 1 - init_bet is in % of available funds; 0 - init_bet is in currency units |

| stake_type | 1 - init_bet = bet size; 2 - init_bet = bet liability (for laying) or profit (for backing) |

| target_loss | Maximum loss (% of bank) after which the triggers stop betting |

| target_profit | Maximum profit (% of bank) after which the triggers stop betting |

| cycle_length | Number of steps in the loss recovery cycle (0 if no recovery) |

| max_recovery_odds | Maximum price during the loss recovery cycle |

| max_bets | Maximum number of markets with simultaneous bets |

| min_distance | Minimum race distance in meters |

| max_distance | Maximum race distance in meters |

| min_vol_gap | Minimum volume % gap between the two selections with the maximum volume, % |

| max_vol_gap | Maximum volume % gap between the two selections with the maximum volume, % |

| greenup_prc | Minimum green-up percentage (set to a negative number if you are prepared to trade out with a loss) |

Day 1, June 07, 2022

Starting with Strategy 1. Here is the set of original triggers:

Download triggers for Strategy 1

These are the settings I started testing with:

| min_odds | 1.01 |

| max_odds | 100 |

| min_runners | 1 |

| min_rank | 1 |

| max_rank | 8 |

| mins_before_start | 3 |

| greenup_time | 0 |

| init_bet | 1 |

| relative_bets | 1 |

| stake_type | 1 |

| target_loss | 50 |

| target_profit | 50 |

| cycle_length | 0 |

| max_recovery_odds | 100 |

| max_bets | 5 |

| min_distance | 0 |

| max_distance | 5000 |

| min_vol_gap | 5 |

| max_vol_gap | 80 |

Total P/L: -34.54

ROI: -1.08%

Wins: 69, losses: 86

Download Statement for 07/06/2022

Day 2, June 08, 2022

Total P/L: -85.62

ROI: -2.55%

Wins: 60, losses: 125

Download Statement for 08/06/2022

Day 3, June 09, 2022

Total P/L: -78.9

ROI: -2.34%

Wins: 78, losses: 124

Download Statement for 09/06/2022

Day 4, June 10, 2022

As you can see, the first three days were not looking very promising. There were much more losses than wins, and I lost 20% of my bank, despite liabilities in each race being less than £1 on average. Looking at the logs, I can see that on some occasions the trade-out bets were not placed (the market closed sooner) or they were placed but not matched. That added to the gloomy picture.

At about 2 pm on that day I decided to drop the trade-out bet and move the time of the back bet by 1 minute closer to the start. The reason? The gap between the back and lay prices starts narrowing at about that time, so I was hoping to secure better prices. These are the settings I changed:

| mins_before_start | 2 |

I disabled the trade-out trigger, but kept the rest of the triggers unchanged.

Download triggers for Strategy 2a

Total P/L: 251.67

ROI: 9.57%

Wins: 75, losses: 144

Download Statement for 10/06/2022

Day 5, June 11, 2022

The change has obviously produced a dramatic effect, but I am never convinced until I've run a particular configuration for a few days.

Total P/L: 76.28

ROI: 23.67%

Wins: 14, losses: 18

Download Statement for 11/06/2022

Day 6, June 13, 2022

Did you notice a one-day gap here?

On June 11, the triggers stopped in the morning because... the stop-profit trigger has kicked in! I was 50%+ in profit. Remember I restarted the triggers on June 10? My bank balance was £724.38 at that moment, and now it was £1,129.04, so (1129.04 - 724.38)/724.38 = 55.68%.

Unfortunately, I didn't check in to the server up until June 13, and then only late in the evening. For that reason, I reloaded the triggers after 9 pm, and they only managed to place one bet that day.

Total P/L: -11.29

ROI: -100%

Wins: 0, losses: 1

Download Statement for 13/06/2022

Day 7, June 14, 2022

Starting from today, I decided to take the findings from that BFStats report and alter my Market Locator search template, so that it selected markets based on their distance.

In the final setup file, I have deliberately taken out some of the race distances and added others, so that you would still have some incentive to check out the actual report.

The third set of triggers would only back in markets with the following distances:

| 462m | 490m | 460m |

| 480m | 395m | 270m |

| 380m | 455m | 520m |

| 476m | 530m | 350m |

| 450m | 300m |

I changed the way the bet size was calculated: a percentage of the current balance rather than of the available funds.

Also, to prevent the triggers from stopping once again if they have lost or won 50% of the bank, I pushed those caps up to 150% each:

| target_loss | 150 |

| target_profit | 150 |

From then on, the triggers were running uninterrupted with no other changes.

Total P/L: -48.08

ROI: -2.37%

Wins: 70, losses: 133

Download Statement for 14/06/2022

Day 8, June 15, 2022

Total P/L: 317.3

ROI: 28.59%

Wins: 37, losses: 60

Download Statement for 15/06/2022

Day 9, June 16, 2022

Total P/L: 61.01

ROI: 4.62%

Wins: 34, losses: 59

Download Statement for 16/06/2022

Day 10, June 17, 2022

Total P/L: -31.55

ROI: -3.35%

Wins: 25, losses: 42

Download Statement for 17/06/2022

Day 11, June 18, 2022

Total P/L: -154.32

ROI: -16.62%

Wins: 20, losses: 50

Download Statement for 18/06/2022

Day 12, June 19, 2022

Total P/L: 52.48

ROI: 8.63%

Wins: 18, losses: 29

Download Statement for 19/06/2022

Day 13, June 20, 2022

Total P/L: 44.47

ROI: 4.42%

Wins: 26, losses: 45

Download Statement for 20/06/2022

Day 14, June 21, 2022

Total P/L: 46.78

ROI: 3.93%

Wins: 30, losses: 53

Download Statement for 21/06/2022

Day 15, June 22, 2022

Total P/L: -206.12

ROI: -19.85%

Wins: 25, losses: 56

Download Statement for 22/06/2022

Day 16, June 23, 2022

Total P/L: -217.62

ROI: -23.45%

Wins: 23, losses: 59

Download Statement for 23/06/2022

Day 17, June 24, 2022

Total P/L: 495.73

ROI: 50.77%

Wins: 41, losses: 44

Download Statement for 24/06/2022

My bank balance and statistics:

| Starting Bank: | 1,000 |

| Final Bank: | 1,477.91 |

| Max. Drawdown: | -282.86 |

| Max. Profit: | 563.93 |

| Max. single-bet loss: |

-101.7

|

| Total P/L: |

477.91

|

| ROI: | 1.67% |

| Strike Rate: | 43.86% |

Not only di the triggers produce profit compared to the starting bank, the third set of triggers has actually recovered the initial loss of £200+ at the start of this testing session!

However, you can see a significant collapse of the graph line on the last day of testing (down to £890), just before it skyrocketed again to £1,477.91. The collapse was due to a very long streak of losses in Australian markets. What I learned after this testing session has ended, by looking at the statements, is that if I hadn't backed in Australian markets altogether, I would have won £547.73 instead of £477.91. Looks like Australian markets were just standing in my way, although you will get a clearer understanding of the country-by-country picture if you look at the BFStats report.

The triggers available in the setup file can also place LAY bets instead of BACK, just activate the corresponding trigger. Although I did not use any loss recovery in my testing, it is supported by the triggers; you need to set cycle_length to anything > 0 to enable it.

If you liked this report, subscribe to our newsletter (below) and be the first to learn about new reviews and new services!

Download the trigger installation file above and start testing this strategy right now! Are you not using MarketFeeder Pro yet? Try now!

How and where I test the triggers?

I use our BetVPS service to pre-set the triggers and Market Locator and leave it to run on its own until I check on the results at the end of the day.I occasionally use Time Machine to get a proof of concept or test any tweaks that I want to make to my triggers, on historical markets similar to the ones in which I bet when testing a particular strategy.

I use Test Mode only.

You can generate your own graph and statistics like the ones in these Triggers in Action reports. Read how to do this.

If you would like a unique guest-post for your blog covering one of such strategies, please email me a request.